Wealth Management

Become the go-to place for retirement income advice

Amplify a financial advisor’s value and productivity in retirement income planning and management.

- Grow revenue through product conversion, client acquisition and asset consolidation

- Improve advisor's productivity, releasing time for business development

- Increase advisor and client retention, and reduce regulatory risk through an institutionalized consistent process

Put an end to ineffective trial-and-error effort in

retirement income planning

Post-retirement income management is a new challenge. Social Security claiming, lifetime annuity allocation, Roth conversions, and pension settlement options add massive complexity. Advisors deal with thousands of options.

Current financial planning tools require advisors to manually play with levers to try to find the optimal solution, which is not a good use of their time. Advisors want an easy solution that will do the heavy lifting of analyzing thousands of strategies and make them feel confident about the optimal recommended strategy.

Evaluate all possibilities

with one click

AIDA, our intelligent engine, produces the optimal mix to increase a retiree’s post-tax Safe Retirement Income by as much as 30%1 or increase after-tax legacy by as much as 5 times2.

This is essential for advisors who want substantial growth in their retirement income business.

Advisors can guide clients through the optimal path to a Full & Rich retirement.

Modules to scale your retirement

income business

Safe Income Portal for prospecting, Income Planning 2.0 for comprehensive income planning, and Paycheck for distribution management

Our solutions are available as an API. Built for quick integration, the API can extend

your

current financial planning experience with retirement income capabilities.

Prospect with Safe Income Portal:

two minutes and seven data points generate

personalized results

A friendly conversation shows retirees the value of engaging with an advisor to obtain their personalized Safe Income strategy.

- Likely to exceed client’s expectations of retirement income

- Works to solidify trust in the advisor and your firm

- Improves a prospect’s confidence in engaging further for a comprehensive income plan

- Prospects may flow into your CRM

Income Planning 2.0, featuring

One-Click Plan Building

For savvy advisors, it’s love at first sight.

Now your advisors can deliver a personalized strategy that is fully co-optimized, not trying each lever in isolation, all with a single click.

- Social Security claiming

- Allocation to annuities for lifetime income and investment portfolio allocation

- Optimal incremental effective tax rates for discretionary disbursals from qualified accounts, for both retirement income and Roth conversion - read our blog

- Dynamic tax strategies for non-qualified accounts target tax-free capital gains, then minimizing taxable capital gains - read our blog

- Permanent life insurance - either as cashflow or a death benefit

Our powerful Income Planning 2.0 simplifies analysis. Advisors using it are enthusiastic.

Provide solid answers with a client

presentation under your brand

A personalized presentation answers client questions in a clear, concise format, and demonstrates Best Interest for 401(k) rollovers and annuity purchases.

May make client decisions easier – and may boost acceptance rates by more than 200%.

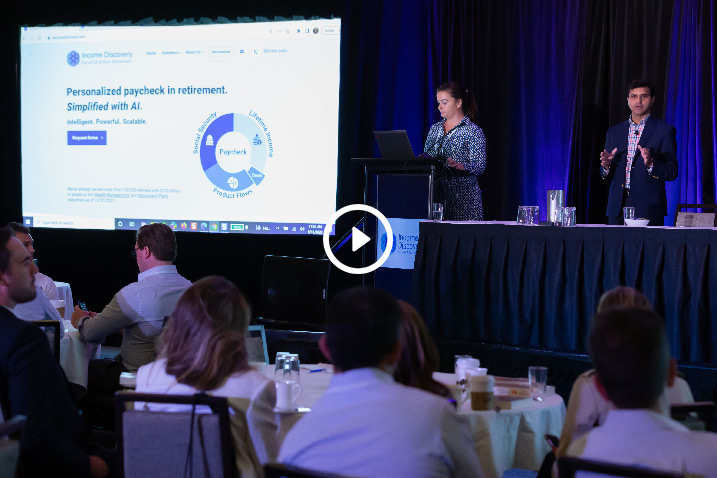

Paycheck:

Manage more retirees, more effectively

Executing against a selected income plan, you’ll get clear

instructions on planned

spending,

unplanned spending and Roth conversions. AIDA will:

Collect Financial Information

- Managed and held away account holdings and balances

- Social Security, annuity and cash flow amounts and COLA adjustments

- AIDA estimates federal and state taxes

Execute the Strategy

- Determine annual planned expense requirements with variations and inflation adjustments

- Source withdrawal needs optimally and holistically across tax type accounts, RMDs and all other cash flows

- Flexibility and support for unplanned expenses

Monitor Plan Safety

- Definitively answer the question “Am I safe?” for clients

- See whether the plan is healthy or the amount of any income adjustment

- Determine if replanning is necessary

Take your productivity to the next level - and make more clients happier.

SafePathSM: a personalized path to track

safety and determine adjustments

The SafePathSM measures the effectiveness of a client’s selected retirement income plan.

- Provides a clear picture of all future retirement years by answering the question: “Am I Safe?”

- Removes the uncertainty around income adjustments and alleviates the fear of running out of money

- Empowers advisors to assist with unplanned, ad-hoc expenses when retirees are in the safe zone

A multi-trillion-dollar

market is waiting for you

Your advisors can grow their retirement income business at scale. All while

clients enjoy end-to-end,

tax-efficient retirement income planning and delivery of retirement paychecks.

Call: 888-966-9469

Email: sales@incomediscovery.com