Personalized

paycheck in retirement.

Intelligent. Simplified. Scalable.

Modules for Income Advice & Paycheck

Our capabilities are driven by our fiduciary advice engine AIDA: Income Planning 2.0 for comprehensive income planning and Paycheck for distribution management.

Intelligent Retirement

Income

- AIDA combs through thousands of strategic options to determine a personalized optimal strategy for each client.

- It can maximize safe spending for an underfunded client, maximize confidence, or meet spending safely and maximize legacy for an overfunded client.

- AIDA quantifies the advisor’s value - a gamma of as much as 275 basis points.

Income Planning 2.0,

featuring One-Click Plan Building

This income advice solution provides advisors a client’s optimal retirement income strategy with one-click.

For savvy advisors, it’s love at first sight. Now your advisors can deliver a personalized strategy that is fully co-optimized, not trying each lever in isolation, all with a single click.

- Social Security claiming

- Allocation to annuities for lifetime income and investment portfolio allocation

- Optimal incremental effective tax rates for discretionary disbursals from qualified accounts, for both retirement income and Roth conversion - read our blog

- Dynamic tax strategies for non-qualified accounts target tax-free capital gains, then minimizing taxable capital gains - read our blog

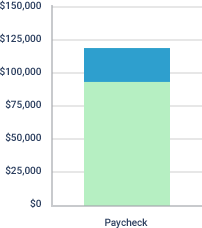

Paycheck in retirement

A solution to manage planned spending, unplanned spending, and Roth conversions during retirement.

Integrates with your existing planning tools and systems to deliver tax-optimized quarterly withdrawals.

SafePathSM: a personalized path to track

safety and determine adjustments

- Provides a comprehensive outlook on upcoming retirement years, addressing the question, "Am I Safe?"

- Simple and quick answer: if the portfolio balance is within the Safe Zone, continue to spend as planned and could even consider additional discretionary distributions.

- If the portfolio balance enters the Adjustment Zone, a recommendation is made to reduce retirement spending.

Generally, a retiree's actual portfolio balances are expected to be in the Safe Zone.

Solutions specialized to meet

your needs

Our solutions are available as a white label UI or API. All are customizable, flexible, and designed to provide value across multiple market segments. Each solution is built for quick integration. Explore how they can help your unique business grow.

Wealth Management

Use our solutions to build your retirement income business at scale. Enable advisors with the highest probability of winning new business with minimal inputs. Advisors will save time, deepen ongoing relationships with retirees, and increase revenue through referrals and asset consolidation.

Retirement Plans

Offer retirement income solutions designed with multiple benefits for the retiree and the recordkeeper. For the recordkeeper, solutions allow retention of participant assets nearing and post-retirement. Provide a superior offering to win plans and retain existing plans with potential additional revenue.

Service Organization Control (SOC) Compliant

Call: 888-966-9469

Email: sales@incomediscovery.com